carried interest tax proposal

Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary income. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees.

10 Partnership Agreement Templates Word Excel Pdf Templates Templates Free Design Templates Rental Agreement Templates

The proposal which is part of a 35 trillion tax and spending package that House leaders say could get a vote by Oct.

. Carried Interest Raises 141 billion. The proposal would expand the type of gainincome from carried interests that are subject to the holding period rules applicable to carried interest. WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White House economist Jared.

Carried-Interest Tax Break Shrinks Survives in Democrats Plan Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats. The most recent attempt to address carried interest was in 2017 under then-President Donald Trump. That bill was estimated to raise only approximately 156 billion over a 10-year period.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. It would also extend the carried-interest rules to all assets eligible for long-term capital gains rates. The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest as a perk for private equity.

Some view this tax preference as an unfair market-distorting loophole. The Congressional Budget Office has estimated that taxing carried interest as ordinary income would raise 14 billion over a decade. It is proposed that eligible carried interest will be.

1639 would treat the grant of carried interest to a general. On August 5 2021 Senate Finance Committee Chairman Ron Wyden and Senator Sheldon Whitehouse introduced proposed legislation the Ending the Carried Interest Loophole Act or the Proposal that would substantially change the US. Benefits of the Carried Interest Legislative proposals to reduce or eliminate the tax benefits of the Carried Interest have failed on several occasions in the last 10 years including in 2017 3 year holding period rather than 1 year to obtain long-term capital gain treatment Holding period applies to sale of Carried Interest.

Minimum Tax on Certain Taxpayers The budget would impose a 20 percent tax on total income including unrealized capital gains for taxpayers with net assets exceeding 100 million. Carried Interest Tax Proposal Threatens Charitable Giving Elizabeth McGuigan Sector Regulation October 28 2021 Last month the House Ways and Means Committee marked up the Build Back Better Act to include a provision modifying how carried interest is. Eligible carried interest is defined as a sum received by or accrued to a person by way of profit-related return subject to a hurdle rate which is a preferred rate of return on investments in the fund.

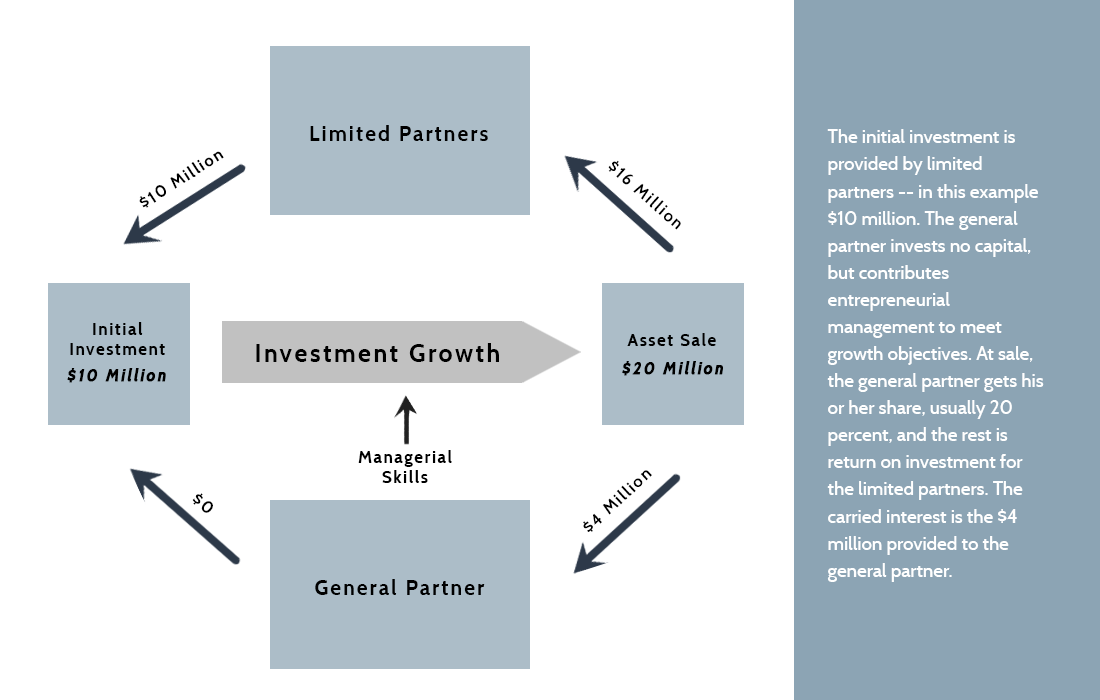

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. 14 Sep 2021 0. The matter has been adjourned for now.

Federal income tax treatment of partnership interests issued in exchange for services commonly known as carried interests. But in reality the tax as proposed in the administrations plan would impact partnerships of all sizes including those with individual partners earning less than the. The proposal provides that the concessional tax rate would apply on carried interest paid for management services provided in Hong Kong by.

Under the proposal gain from the sale of active business assets section 1231 gain and qualified dividend income QDI could be subject to STCG treatment if the holding period for carried interest is. Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses. The Ways and Means Committee in an informal estimate claims the same amount of savings from its proposed change.

Levins bill proposed a different regime for taxing carried interest that addressed character but not timing of income inclusion. The proposal would generally extend the three-year holding period required for carried interest to be taxed as a capital gain as opposed to ordinary income to five years. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration could create Securities and Exchange Commission disclosure.

The proposed Ending the Carried Interest Loophole Act S. The top individual rate would be 396. The proposal would also prevent private-equity and hedge fund managers from applying the long-term capital gains tax rate to their portion of the funds profits known as carried interest if their.

House Ways and Means Committee Chairman Richard Neal on Monday proposed a major set of tax hikes to fund Democratic President Joe Bidens social spending plans one tax break popular among major Democratic Party donors was left in placethe taxation of carried interest income at the lower capital gains rate. 1 lengthens the time period investment funds must hold assets to five years. The proposals would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan.

The proposed carried-interest change would include some exceptions retaining the three-year holding period for real property trades or businesses and taxpayers earning less than 400000. However carried interest attributable to a real property trade or business would retain a three-year holding period requirement. The budget proposes to tax carried interest at ordinary income tax rates as opposed to capital gains tax rates if a taxpayers income exceeds 400000.

Corporations licensed under Part V of the Securities and Futures Ordinance or an authorized financial institution registered under Part V for carrying on business in any regulated activity as defined in Part 1 of Schedule.

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

Budget 2020 New Tax Saving Proposal For Salaried Individuals Artist Salary Makeup Artist Salary Makeup Services

Gst Consulting Services Accounting Online Accounting Software Accounting Services

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Ca Income Tax Tax Deductions Tax Refund

The Tax Treatment Of Carried Interest Aaf

Ethereum Reaches Another All Time Record High At 4200 All About Time Forex Trading News Tax Advisor

Do You Already Know The Tax Changes Proposed In The Biden Treasury Green Book In 2021 Business Tax Deductions Proposal Business Tax

Safety Blog Policy Template Small Business Organization Personal Protective Equipment

Do You Already Know The Tax Changes Proposed In The Biden Treasury Green Book In 2021 Business Tax Deductions Proposal Business Tax

Employee Benefits Summary Template Employee Benefit Health Savings Account Templates

Create A Fillable Form With Word Car Sales Contract Bing Invoice Template Cars For Sale Sales Template

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Collaboration Tools Which Boost Stakeholder Engagement Engagement Strategies Stakeholder Management Business Management Degree

What Is Middle Class Income Infographic Business Infographic Infographic Income

Partnership Agreement Template Real Estate Forms Agreement Sales Template Templates

The Realty Developers In Yamuna Expressway Have Been Warned By Authorities That No Flats Could Be Booked Or Construction Activities Carried Ou World Agra India